Collections doesn’t have to feel like collections

With 70% of U.S. GDP driven by consumer spending, collections are a cornerstone of economic stability. However, traditional collection methods are often viewed as disruptive, intrusive, or adversarial. The industry must evolve to meet new consumer expectations of flexibility, personalization, and respect while balancing the increasing regulatory scrutiny on collection practices.

The future of collections is different—empathetic, tech-driven, and consumer-centric. AI and machine learning (ML) are reshaping collections into hyper-personalized, proactive engagements that improve recovery rates, enhance consumer trust, and protect brand reputation. Meanwhile, the regulatory environment continues to shift, requiring compliance-first strategies that mitigate risk while ensuring operational efficiency.

The landscape: why change is necessary

The collections industry is undergoing a seismic shift, driven by three key forces:

Consumer debt is at record highs

- U.S. consumer debt has surged to $17.94 trillion, with delinquency rates rising across credit cards, auto loans, and personal loans.

- Economic uncertainty and high interest rates are further stressing household finances, making effective yet compassionate collections more critical than ever.

Regulations are tightening

- The CFPB’s fee caps and enforcement actions reflect an aggressive push for consumer-friendly policies.

- State-level regulations vary widely, requiring agility and real-time compliance monitoring to avoid legal risks.

- Transparency, opt-in communication preferences, and ethical engagement are no longer optional—they’re business imperatives.

Reputation & consumer expectations matter more than ever

- Digital-first consumers expect seamless, self-service, and non-intrusive financial interactions.

- Negative collection experiences can result in brand damage, social media backlash, and loss of customer loyalty.

- Collections must shift from confrontation to collaboration—empowering consumers to resolve their debt in a way that are flexible and aligns with their financial reality.

The solution: AI-powered, empathy-first collections

AI and ML enable collections teams to move beyond generic, one-size-fits-all approaches toward highly tailored, data-driven strategies. By understanding, predicting, and personalizing engagement, collectors can create a more positive consumer experience while maximizing collection rates.

Key trends for 2025

Hyper-personalization

- AI can be used to analyze past repayment behaviors, financial habits, and communication preferences to create tailored outreach strategies.

- Dynamically adjusting payment plans based on real-time consumer interactions improves success rates.

Omnichannel engagement

- Consumers expect convenience and choice—from text messages to chatbots to phone calls.

- AI-driven omnichannel outreach (text, email, IVR) meets U.S. consumer preferences and improves recovery

Mobile-first payments

- The rise of digital wallets, instant payments, and flexible repayment options make mobile-friendly collection strategies critical.

- User-friendly payment portals with intuitive design reduce friction and drive faster settlements.

Predictive analytics for risk assessment

- AI-powered collection models can be used to assess a consumer’s likelihood to pay and prioritize collection efforts accordingly.

- High-risk accounts receive higher-touch interventions, while automated debt collection, self-service options handle lower-risk cases efficiently.

Real-time AI compliance monitoring

- AI-powered compliance tools track changing regulations, audit interactions, and flag potential risks before they escalate.

- AI-powered debt collection improves regulatory compliance under FDCPA & Reg F while increasing right-party contact rates (RPCs)

- Automated scripting and communication guidelines ensure agents stay within regulatory frameworks while maintaining a human touch.

Strategic imperatives for modern collections

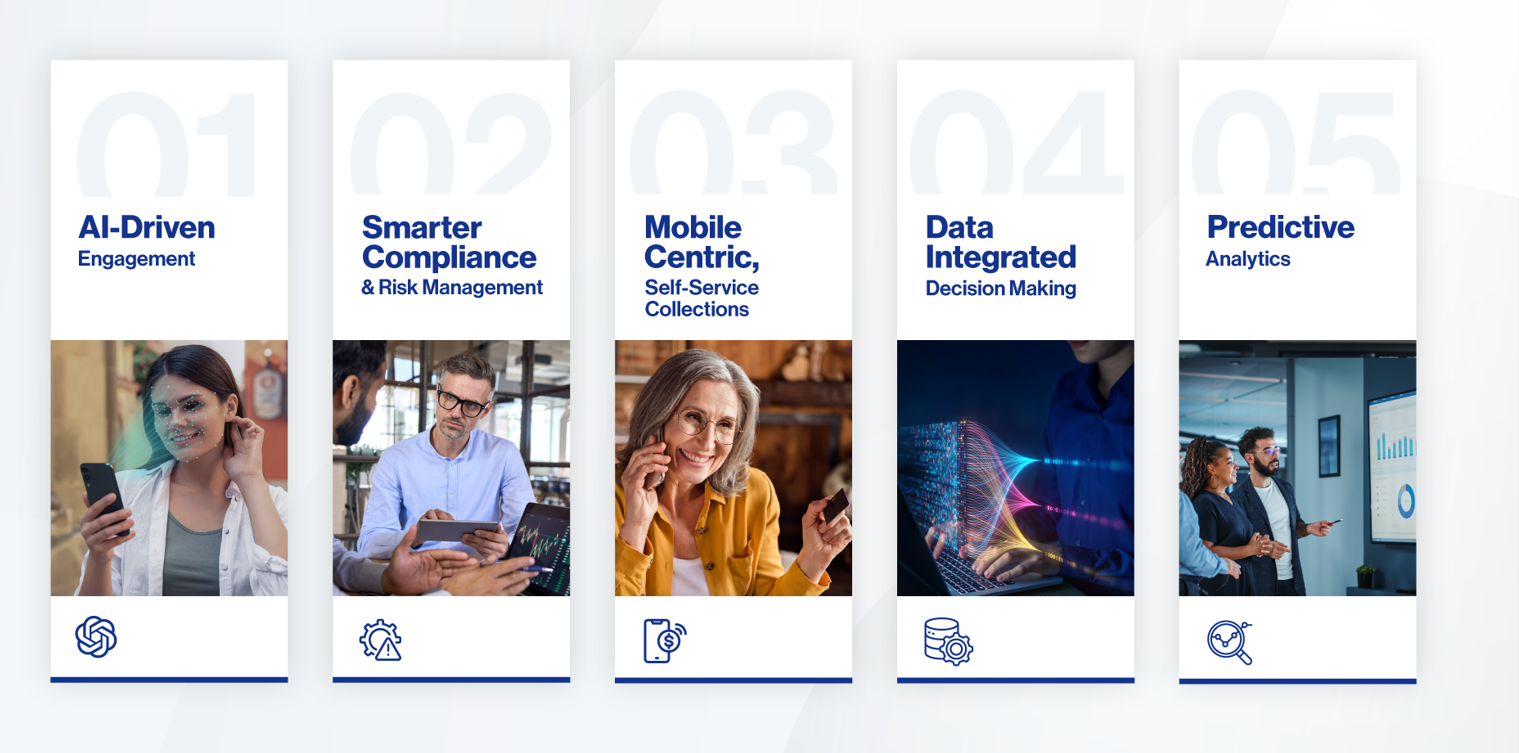

AI-driven engagement

- 40% lower operational costs through automation.

- 20% higher collection rates using behavioral insights.

- 30% improved consumer satisfaction with tailored interactions.

Smarter compliance & risk management

- AI-driven compliance checks reduce risk exposure.

- Automated audit trails ensure documentation is always regulatory-ready.

- Geofencing and jurisdiction tracking ensure state-specific laws are adhered to in real time.

Mobile-centric, self-service collections

- Frictionless mobile payments accelerate settlements.

- Biometric authentication ensures security and trust.

- Self-service collections allow 24/7 digital engagement, reducing consumer complaints by 40%

Data-integrated decision making

- Unified consumer profiles provide holistic insights across accounts.

- AI-powered triaging optimizes collection prioritization and resource allocation.

- Sentiment analysis detects consumer distress and adjusts engagement strategies accordingly.

AI-powered predictive analytics

- Early repayment indicators drive proactive engagement.

- Optimized call timing and payment options increase responsiveness.

- Machine learning models continuously refine collection strategies based on real-time data.

Also read: An effective collection strategy for the digital age

Firstsource: transforming collections with AI & empathy

Firstsource seamlessly integrates AI, automation, and human-first strategies to:

- Ensure compliance amid shifting regulations, reducing legal risk.

- Deliver hyper-personalized outreach for better repayment outcomes.

- Empower customers with self-service tools to take control of their financial obligations—on their terms.

Why firstsource?

- Proven Expertise – Over decades of experience in collections with a deep understanding of compliance and operational efficiency.

- AI & ML powere Capabilities in the U.S – Industry-leading technology that enhances decision-making, customer engagement, and compliance monitoring.

- Consumer-Centric Approach – A focus on empathy and financial empowerment, ensuring better outcomes for both consumers and creditors.

- CFPB-compliant collections strategy

The future of collections: smarter, more human, more effective

By blending AI, data insights, and empathy, collections evolve from an adversarial process into a partnership that benefits both consumers and businesses.

The bottom line:

- Collections doesn’t have to feel like collections.

- Smarter engagement leads to better outcomes.

- AI-powered compliance safeguards your business by adding multiple layers of control.

Let’s redefine collections together. Firstsource can make it happen!